Customer Services

Copyright © 2025 Desertcart Holdings Limited

Desert Online General Trading LLC

Dubai, United Arab Emirates

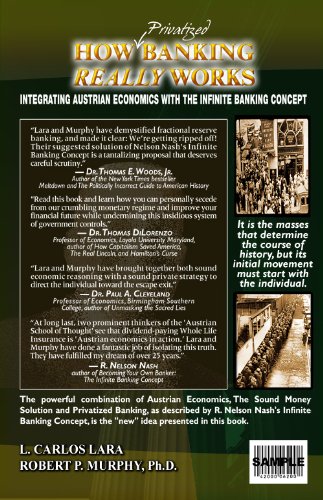

How Privatized Banking Really Works - Integrating Austrian Economics with the Infinite Banking Concept

S**R

A great explanation of how banking works in the U.S. for non-economists/non-bankers

This book is for those of us non-economist/non-banker types out there who want to know how the banking function works in this country. It is written for the layman and does a superb job of explaining how the banking function works, how the Federal Reserve manipulates the economy through interest rate changes, and how leaving the gold standard caused the massive inflation we've seen since President Nixon. It is over 200 pages in length, but is organized well and is easily internalized over multiple short reading sessions. This book is definitely an eye-opener as to how the powers that be, control our money and our economy.

C**X

Next Level Personal Finance

Bob and Carlos lay out a compelling argument to leverage (Nelson Nash's) Infinite Banking System to eliminate the need for traditional financing, and free oneself from the negative impact of paying a bank interest. It's an excellent jumping-off point from programs like Dave Ramsey's Financial Peace. This book, Murphy's essay on IBS, and Nelson Nash's small book on the subject are truly enlightening.

J**S

Mandatory Economics Reading!

If economics were taught in classrooms still, this should be the second mandatory reading! (right behind Hayek's own "Road to Serfdom"). It is so important that people understand how economies work and then use that to their own advantage. Lara's book helps people understand macro and micro economics in an easy format so they can start taking action to build their own road to wealth and financial freedom!

L**7

Banking Secrets

I've found the information extremely helpful and insighful. I must admit I am a rookie when it comes to this kind of financial information but it made me really think about my investments and the goals I have for me and my family. I believe the concepts are a bit overly simplified but still relevant. I have asked several friends, some of whom are financial advisors, and they are aware of the concept but not exactly a cheerleader of the ideas of bank on yourself. Their arguements, in my opinion, were weak with bias toward their "expertise" and "experience". Did any of them actualy use the system? No. Enough said.I actually called an advisor outside my home state who is a huge advocate of the system. His points were...1) Not get rich quick, 2) First purpose is to buy the things one would normally finance at a bank or car dealer to make major purchases, thus paying yourself the interest that the bank would have collected. His idea was that over a 20 to 30 year period one would be miles ahead as the way the policy is set up begins to really multiply in later years. And unlike traditional whole life policies, you or your family keep both the death benefit and the accumulated cash value. 3) a growing death benefit.I have not jumped in with both feet because, basically, you must have expendable income to fund a program, minimum $500 a month. To this fellows credit he explained, answered all of my questions and totally backed off, no pressure.Back to the book. I would recommend it as part of your arsenal of learning! Follow through is up to you.

P**K

Five Stars

Good and informative book. The authors of this book have very good podcasts related to the book's subject.

S**H

I wished I'd known about this process 40 years ago.

I've been paying taxes, fees, and interest to someone else for several decades. Had I known about this process 40 years ago, I would be MUCH better prepared for retirement today. I could have been collecting those extra dollars in my own private banking system.I highly recommend this book. The book is well written but I was forced in spots to re-read (mostly because of I lacked a basic understanding of how our current banking system works).Pure genius!

F**E

A must have book on Privatized Banking

One of the top 4 books on the subject of privatized banking. A must have book if you want to know the subject.

M**G

It makes sense, but the person who wins must ...

It makes sense, but the person who wins must be frugal. Ideally, it is difficult to do if you wait until late in life. It is a way of life that works if you can control your spending starting when you are young.

M**D

Five Stars

Eye opening. A must read for fans of applied Austrian Economics.

Trustpilot

1 day ago

3 weeks ago